At the start of last year, it was far from certain that the Tesco (LSE:TSCO) share price would stage an impressive rally. Against a backdrop of high inflation and an intense battle for market share, some investors might have avoided Britain’s largest retailer.

However, to the delight of shareholders, the supermarket managed to navigate these challenges successfully. Tesco shares soared 27% last year, outperforming the FTSE 100 by a considerable margin.

Here’s why.

Solid sales

Interim results for the first half showed plenty of promise. Group sales rose 8.9% and adjusted operating profit increased 14% to £1.48bn, beating analysts’ expectations.

Fears that elevated wage and energy costs might weigh on the company’s performance proved to be unfounded.

The evidence so far suggests that Tesco has traversed the inflationary climate admirably. Perhaps the clearest sign of this is the board’s upgraded FY23 retail adjusted operating profit forecast. Tesco now anticipates it will deliver between £2.6bn and £2.7bn, up from a previous £2.5bn estimate.

The Q3 and Christmas trading statement is due on 11 January. This should provide further insight into how the supermarket fared over the crucial festive period.

Every little helps

While retail operations remain the core of the business, it’s encouraging to see Tesco firing on all cylinders.

It also owns Booker, a wholesale distributor. Catering volume growth has helped this arm, which delivered like-for-like sales growth of 7.5%.

Moreover, Tesco Bank has benefitted from higher interest rates. This division looks to be in solid shape, providing useful diversification and another string to the group’s bow.

Competition

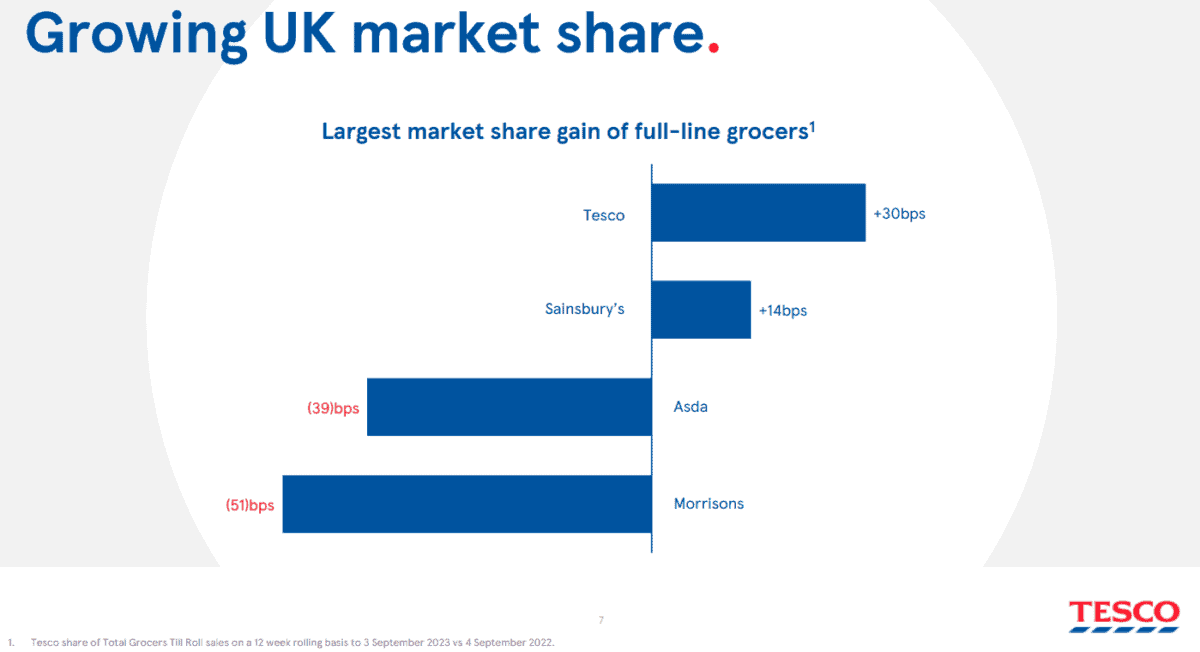

Competitive threats from rival retailers are a key risk facing the Tesco share price. Britain’s grocery market is notoriously cutthroat and margins are tight. The presence of German discounters Aldi and Lidl has made life more difficult for homegrown retailers.

That said, Tesco has done well to keep its market share above 27%. An Aldi price-matching strategy across hundreds of products appears to be bearing fruit. Tesco’s balance sheet strength is an advantage here against its more highly leveraged competition.

However, I have concerns surrounding the competitive landscape. A full-blown price war would put significant pressure on the firm’s profitability, despite its deep pockets. In addition, any potential merger between Tesco’s rivals could disrupt the market and potentially limit further share price growth.

Granted, a few years ago, the Competition and Markets Authority torpedoed a proposed tie-up between Sainsbury’s and Asda. Nevertheless, the regulator may not take the same view on future proposals.

Deflation

Finally, there are concerns that as inflation turns into deflation, profit margins could be under stress across the sector.

Tesco has managed high inflation rates well, so I have confidence in the board’s ability to rise to this new challenge.

Nonetheless, potential investors should note that long-term risks could be posed by deflationary trends.

A stock to buy in 2024?

As trading conditions evolve, I’ll be monitoring Tesco’s results to check it remains on track. After all, it faces several risks.

However, the retailer looks like a well-run business at present. I think there’s a good chance it could repeat last year’s impressive performance in 2024. Plus, there’s a tasty dividend too.

If I didn’t already own Tesco shares, I’d buy some today.